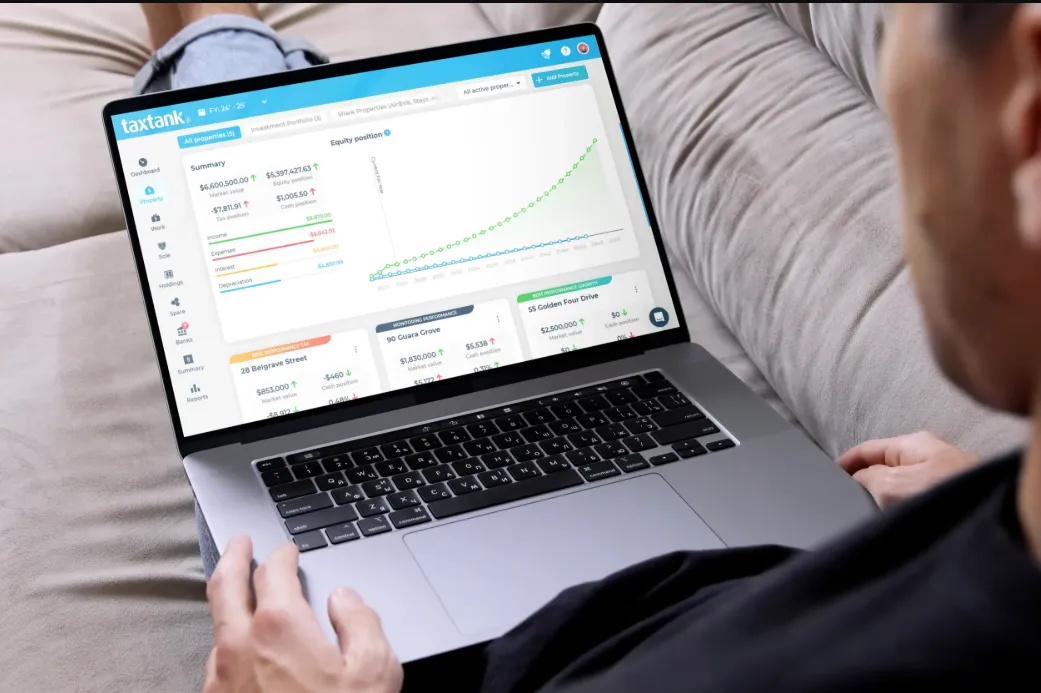

As a landlord, you may find yourself overwhelmed by the financial demands of managing rental properties. Whether you own one or multiple properties, understanding how to effectively manage these finances is crucial. This is where rental property accounting software becomes invaluable. Designed specifically for real estate investors, this type of software simplifies financial management, reduces errors, and provides insightful analytics.

Making the Move to Paperless Rental Accounting

The traditional methods of managing finances with paper records and spreadsheets can be labor-intensive and error-prone. Transitioning to a paperless system can significantly alleviate these burdens.

- Automation and efficiency: Paperless accounting software automates repetitive tasks, freeing up time for landlords to focus on growing their business. Automated invoices and real-time validation help keep operations smooth and accurate.

- Cost savings: By reducing the need for physical storage and printing, landlords can cut down on unnecessary expenses.

- Scalability: As your portfolio grows, a digital system ensures you can manage more properties without becoming overwhelmed. The software supports large residential and commercial property portfolios with cloud storage and integrations.

Switching to a complete digital accounting system not only streamlines processes but also supports better business growth.

Benefits of Rental Property Accounting Software

If you’ve been managing your finances manually, embracing accounting software for property management can be a revelation.

- Centralized financial information: A centralized digital system means no more hunting for scattered documents. All financial data, including bank statements, is stored and easily accessible.

- Automated calculations and reporting: The need for manual calculations is eliminated with software that generates profit and loss reports and tax forms like Schedule E.

- Accuracy and compliance: Software helps maintain accuracy, and tracks income and expenses, ensuring tax readiness and compliance without the stress of manual tracking.

By providing these features, the software simplifies daily accounting tasks and prepares you better for tax season.

Choosing the Right Rental Property Accounting Software

With a variety of commercial real estate accounting software and accounting software for property management available, choosing the right one can be daunting. Here’s what to consider:

- Cost: The software should fit within your budget while offering the features you need. Look for platforms that provide flexible pricing models, whether tiered, unit-based, or add-on.

- Usability: For many landlords, ease of use is paramount. Select a platform that’s intuitive and user-friendly.

- Integration options: Ensure that the software can synchronize with your bank and property management tools. These integrations allow seamless data flow and comprehensive financial management.

- Features offered: Look for essential features such as receipt tracking, report generation, and tax form creation. These functionalities enable efficient property management and accounting.

Choosing wisely will set a strong foundation for your financial management.

Beginner Tips for Using Rental Property Accounting Software

Starting with new software can be challenging. Here are some tips to ease the transition:

- Connect a separate bank account: By linking a dedicated bank account to your software, you can automate income and expense tracking.

- Familiarize yourself with features: Spend time understanding the software’s capabilities to utilize its full potential.

- Leverage automation tools: Use automation to handle the bulk of repetitive accounting tasks, allowing you to focus on other areas.

- Review financial metrics: Regularly assess the metrics provided to optimize your rental business’s profitability.

- Conduct monthly reviews: Regular checks ensure your financial records are accurate and up-to-date.

These tips will enhance your efficiency and proficiency with rental accounting software.

Streamlining Tax Season

Tax season often brings stress, especially for landlords juggling multiple properties. Rental property accounting software simplifies this by:

- Organizing financial records: Everything is in one place, eliminating the scramble to gather documents.

- Automating bookkeeping: This reduces errors and saves time in preparing for taxes.

- Generating tax reports: Easily create reports such as Schedule E, ready for filing or providing to your CPA.

With this software, tax season becomes just another part of streamlined operations.

Integrating Accounting and Property Management Software

Combining accounting and property management software offers landlords a powerful tool for growth:

- Enhance reporting and insights: Integrated solutions provide comprehensive views of business performance.

- Simplify financial management: Built-in compliance and security measures protect your data while enhancing communication.

- Automate processes: Save time and money with automation, supporting scalability and efficiency.

By adopting a cohesive approach with integrated software, landlords can optimize operations and prepare for long-term success.

The Future of Your Rental Property Business

Investing in rental property accounting software is more than a convenience—it’s a smart financial strategy. By choosing a tool tailored for landlords and real estate investors, you gain access to features that simplify complex tasks and set your business up for success. From reducing administrative burdens to optimizing tax preparation, the right software can make a significant difference.

In conclusion, leveraging technology in property management and accounting not only streamlines operations but also empowers landlords to make informed financial decisions, paving the way for long-term success.